Here are some common accounting mistakes to avoid:

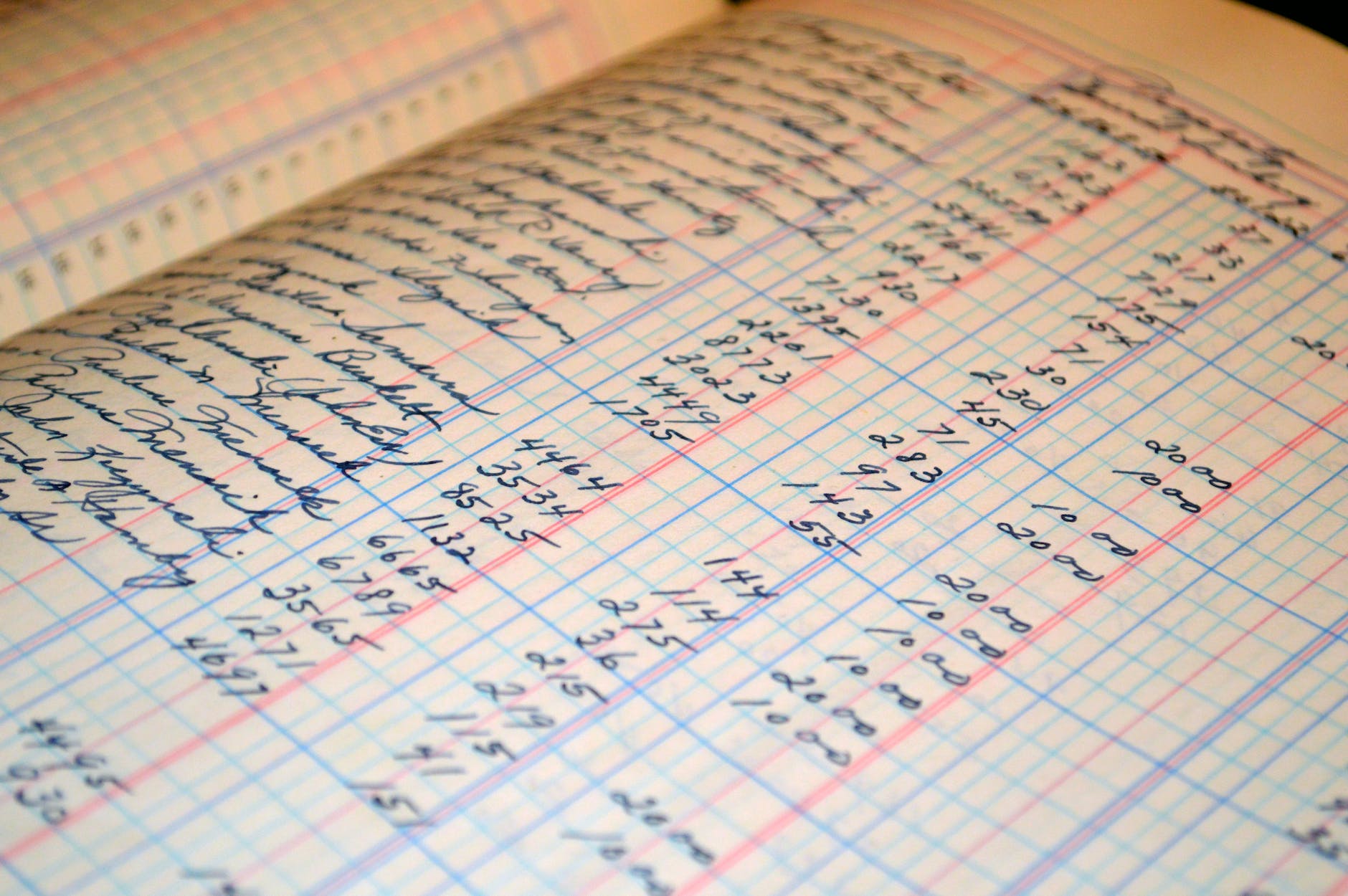

- Not keeping accurate records: Accurate record-keeping is essential for proper accounting. Ensure that all financial transactions are properly recorded in a timely and accurate manner.

- Not reconciling accounts: Failing to reconcile accounts regularly can lead to errors and discrepancies. Reconciling accounts can help identify errors, missing transactions, or fraudulent activity.

- Mixing personal and business finances: Keeping personal and business finances separate is important for accurate accounting. Mixing them can make it difficult to track business expenses and may result in confusion when it comes time to file taxes.

- Not tracking cash flow: It is important to have a clear understanding of cash flow to manage a business effectively. Failing to track cash flow can lead to a shortage of funds and may result in cash flow problems.

- Not planning for taxes: Tax planning is an important part of accounting. Failing to plan for taxes can result in unexpected tax bills and penalties.

- Not keeping up with regulations: Accounting regulations are constantly changing, and it is important to stay up to date with them. Failing to do so can lead to noncompliance, fines, and legal issues.

- Not seeking professional help: While it may be tempting to handle accounting in-house, seeking professional help can be beneficial. An experienced accountant, such as myself, can provide valuable advice, help avoid mistakes, and ensure compliance with accounting regulations.