Category: Tax

-

Wrapping Up Tax Season: Ensuring Your Tax Returns are Complete and Accurate

•

As the tax season draws to a close, it’s crucial to ensure that your tax returns are finished with precision and care. For many, this time of year can be filled with stress and last-minute scrambling, but with the right approach and guidance, it can also be a period of…

-

Mastering Tax Season: A Strategic Guide for Entrepreneurs and Small Business Owners

•

Tax season is often met with a mix of anticipation and apprehension by entrepreneurs and small business owners. It’s a time when the previous year’s financial decisions are scrutinized, and the effectiveness of one’s tax strategy is truly tested. However, with the right approach, tax season can become an opportunity…

-

Essential Guide to Tax Audit Preparedness

•

Tax season brings with it the possibility of an audit down the line —an event that can stir concern in even the most diligent taxpayers. However, armed with the right knowledge and tools, you can approach an audit with confidence rather than fear. This guide is designed to equip individuals…

-

In the Market for a New Auto- Check Out These 10, Which May Give you Up to a $7,500 Credit

•

The following electric vehicles may qualify for the full $7,500 federal tax credit: These EVs and hybrids are no longer eligible for the tax credit.: The recently introduced tax incentives, valid until 2032, were established in the Inflation Reduction Act with the aim of incentivizing more Americans to purchase environmentally friendly…

-

If You Can’t File Your Taxes By April 18th, Here’s How To Get An Extension

•

Taxpayers who are unable to file their tax return by the deadline can request an automatic six-month extension to file on Form 4868. This extension allows for extra time to gather, prepare, and file paperwork with the IRS. It is important to note that an extension to file the tax…

-

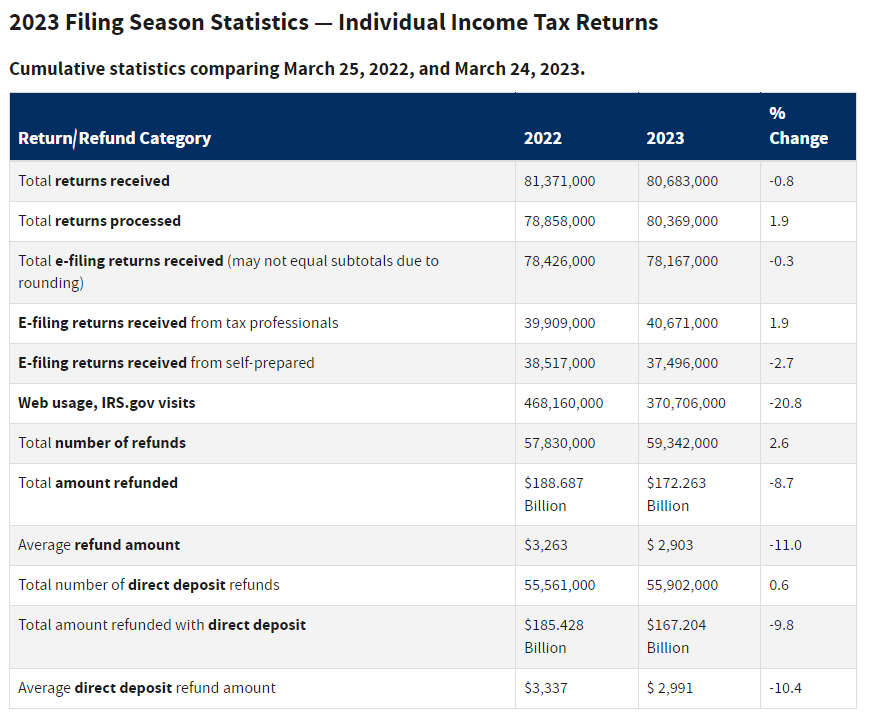

What the 2023 IRS Filing Statistics Tell Us

•

I recently came across the IRS statistics comparing March 25, 2022, and March 24, 2023, and I noticed a significant decrease in the average refund amount from $3,263 to $2,903, which is an 11% decrease. This decrease can be attributed to several factors, including changes to the Child Tax Credit,…