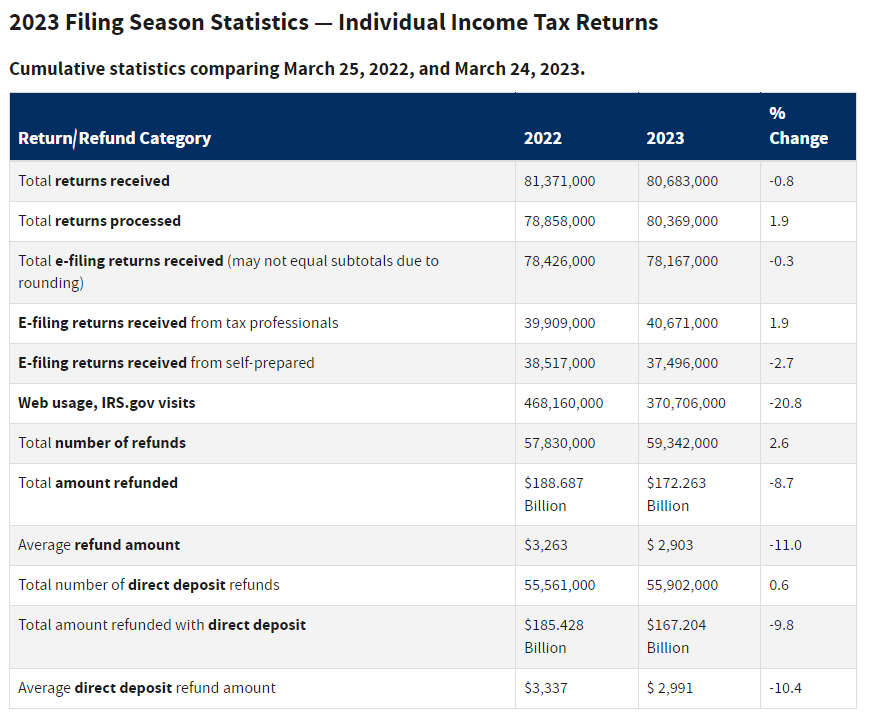

I recently came across the IRS statistics comparing March 25, 2022, and March 24, 2023, and I noticed a significant decrease in the average refund amount from $3,263 to $2,903, which is an 11% decrease.

This decrease can be attributed to several factors, including changes to the Child Tax Credit, Earned Income Tax Credit, and Child and Dependent Care Credit. Parents who received $3,600 per child in 2021 were only be eligible for $2,000 for the 2022 tax year. Additionally, eligible taxpayers with no children who received roughly $1,500 in 2021 only got $500 in 2022. In addition, the Child and Dependent Care Credit returned to a maximum of $2,100 in 2022 instead of $8,000 in 2021.

Another change was that taxpayers could take up to a $600 charitable donation tax deduction on their tax returns in addition to the standard deduction. However, in 2022, those who take a standard deduction could not take an above-the-line deduction for charitable donations.

Lastly, taxpayers who did not receive a stimulus payment or received less than qualified for, got the Recovery Rebate Credit. This is not available for 2022 tax returns.